|

Are you on track? 8 Key Financial Ratios for High Earners in the Bay Area

|

Most people look at money as a constraint around what’s possible for their lives. We do financial planning the other way around.

We start with understanding your vision for your ideal life and then work backwards to design your finances.

Sounds too idealistic?

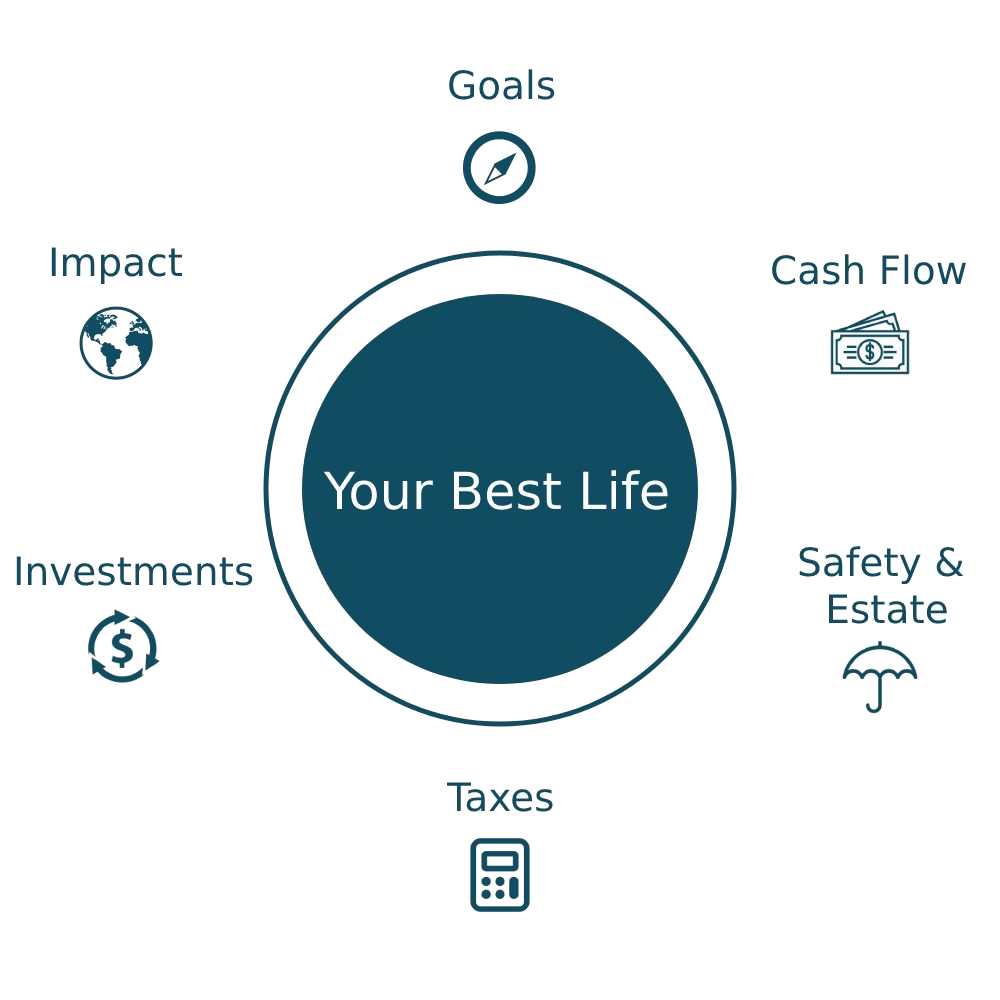

If you’re willing to combine a strategic financial plan with out-of-the-box thinking, that life you’ve been dreaming about is much closer than you think. Through our planning process, we explore the following areas:

We’re here to add value to all areas of your financial life. Think of us as your quarterback and sounding board for all things money.

We utilize a network of legal, insurance, tax, real estate, career and financial professionals when their expertise can be helpful for your needs. If we don’t know the answer, we will help you find it.

As a high earning professional, you pay more than your fair share in taxes. Our goal is to optimize your tax planning so that you can keep more of your income for saving and spending. By strategizing when and how taxes are paid, we aim to better manage your cash flow and reduce your lifetime tax liability.

We provide:

We believe that the best way to achieve your goals is to invest in a portfolio that is globally diversified, simple, tax-efficient and low-cost. We make sure that your investments are customized to your goals, values and tax situation.

We offer our clients direct investment management via Schwab. For your assets that can’t be directly managed (such as 401ks or employer stock), we can link those accounts to our financial planning portal and provide investment guidance.

We provide:

Most people look at money as a constraint around what’s possible for their lives. We do financial planning the other way around.

We start with understanding your vision for your ideal life and then work backwards to design your finances.

Financial Life Design covers:

As a tech employee, you have many opportunities. But stock options (ISO and NSO), restricted stock units (RSUs) and employee stock purchase plans (ESPPs) can be confusing. We help you make the most of your equity compensation and benefits.

We provide:

Being your own boss is exciting, but it also comes with more financial complexity. We help you plan ahead, save for your goals, and manage cash flow to ensure the success of your business as well as your personal financial well-being.

We provide:

We explore your values and goals. Then it’s time to get organized and dig into the nitty gritty.

We start with whatever questions or issues are keeping you up at night. We also explore what obstacles and beliefs might be holding you back.

Investments are one of your biggest tools for financing the life you want.

This is a no numbers meeting.

Money is only a tool for living the life you want. What does that life look like?

We turn your vision into numbers and model out scenarios to assess what’s possible.

We decide on a plan and start putting it into action.

Life isn’t static. Neither is your financial plan.

Our job is to be there for you for the Big Decisions in life, whenever they come up. We’re your advisor on retainer. This means that even if we’re in between meetings, we’re here to talk however many additional times you need.

And if we don’t hear from you, we reach out regularly to make sure that you’re continuing to make progress.

Our fees start at $6,000/year for an individual, $8,000/year for a household.

We provide you with your quote after our second consultation.

$6,000/year

Baseline Fee

$8,000/year

Baseline Fee

1999 Harrison St

Suite 1800

Oakland, CA 94612

415-295-6206

Investment advisory services offered through Equita Financial Network, Inc. an Investment Adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Equita Financial Network also markets investment advisory services under the name, Modern Family Finance, LLC. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

Securities investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Copyright © Modern Family Finance 2023. All Rights Reserved.