|

Am I Financially On Track? A 2026 Guide for Bay Area Tech Professionals

|

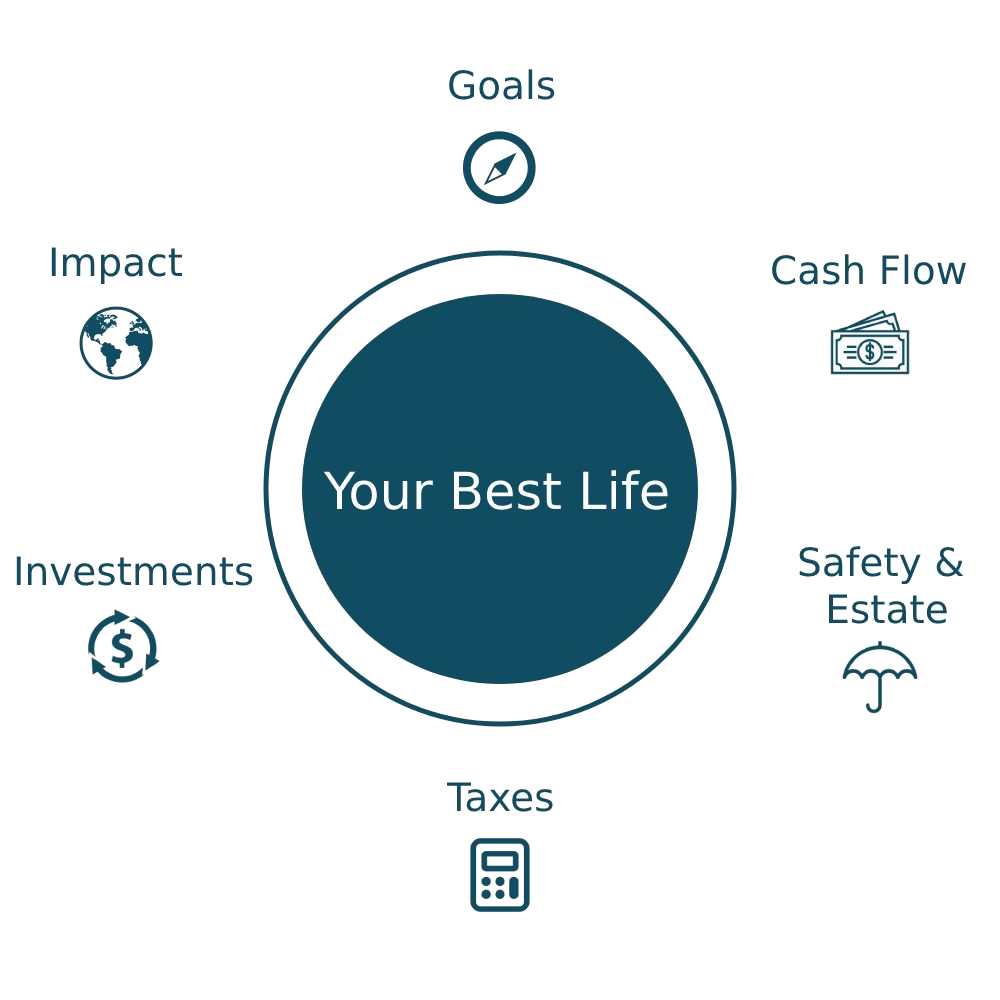

Most people look at money as a constraint around what’s possible for their lives. We do financial planning the other way around.

We start with understanding your vision for your ideal life and then work backwards to design your finances.

Sounds too idealistic?

If you’re willing to combine a strategic financial plan with out-of-the-box thinking, that life you’ve been dreaming about is much closer than you think. Through our planning process, we explore the following areas:

We’re here to add value to all areas of your financial life. Think of us as your quarterback and sounding board for all things money.

We utilize a network of legal, insurance, tax, real estate, career and financial professionals when their expertise can be helpful for your needs. If we don’t know the answer, we will help you find it.

As a high earning professional, you pay more than your fair share in taxes. Our goal is to optimize your tax planning so that you can keep more of your income for saving and spending. By strategizing when and how taxes are paid, we aim to better manage your cash flow and reduce your lifetime tax liability.

We provide:

We believe that the best way to achieve your goals is to invest in a portfolio that is globally diversified, simple, tax-efficient and low-cost. We make sure that your investments are customized to your goals, values and tax situation.

We offer our clients direct investment management via Schwab. For your assets that can’t be directly managed (such as 401ks or employer stock), we can link those accounts to our financial planning portal and provide investment guidance.

We provide:

Most people look at money as a constraint around what’s possible for their lives. We do financial planning the other way around.

We start with understanding your vision for your ideal life and then work backwards to design your finances.

Financial Life Design covers:

As a tech employee, you have many opportunities. But stock options (ISO and NSO), restricted stock units (RSUs) and employee stock purchase plans (ESPPs) can be confusing. We help you make the most of your equity compensation and benefits.

We provide:

Being your own boss is exciting, but it also comes with more financial complexity. We help you plan ahead, save for your goals, and manage cash flow to ensure the success of your business as well as your personal financial well-being.

We provide:

We explore your values and goals. Then it’s time to get organized and dig into the nitty gritty.

We start with whatever questions or issues are keeping you up at night. We also explore what obstacles and beliefs might be holding you back.

Investments are one of your biggest tools for financing the life you want.

This is a no numbers meeting.

Money is only a tool for living the life you want. What does that life look like?

We turn your vision into numbers and model out scenarios to assess what’s possible.

We decide on a plan and start putting it into action.

Life isn’t static. Neither is your financial plan.

Our job is to be there for you for the Big Decisions in life, whenever they come up. We’re your advisor on retainer. This means that even if we’re in between meetings, we’re here to talk however many additional times you need.

And if we don’t hear from you, we reach out regularly to make sure that you’re continuing to make progress.

Our baseline fee starts at $2,500 per quarter. More complex financial needs may result in a higher fee. After our second consultation, we will provide a personalized quote based on your specific needs.

$6,000/year

Baseline Fee

$2,500/quarter

Baseline Fee

*Assets Under Management (AUM) rate is based on the total value of the investments we directly manage for you.