|

Are you on track? 8 Key Financial Ratios for High Earners in the Bay Area

|

Overview

When I used to work in Silicon Valley as a tech employee, I received restricted stock units (RSUs) that helped fuel our financial journey. If you’re a tech employee who aspires to live and work on your terms, your equity based compensation could have the potential to accelerate your path to financial independence. But we know it can feel complicated, especially around taxes.

My go-to guru when it comes to tax is Bay-Area native Kirsten Pfenning, a CPA serving individuals and small business owners with 15+ years of experience.

In this 20 minute video webinar, we walk through a framework for how to think about your equity based compensation decisions and talk about how to use this wealth to support a life that you are excited about. We answer the questions:

Jenni: Hi, this webinar is for people who receive equity based compensation and want to know how to make the most of it. So, you’ve got some equity in your company. It could be in the form of RSUs, ESPPs, or stock options. Perhaps this equity represents a big part of your overall compensation and it’s the main reason why you chose the job that you did. Or maybe it’s just something that’s there, but you don’t think that much about.

In any case, there can be real value to the equity that you hold even in this current volatile stock market environment. It could even have the potential to change your life, but we know it can feel complicated, especially around taxes.

So, today we’re going to focus on RSUs, ESPPs and stock options, and we’ll cover how they work and common pitfalls, especially around taxes. We’ll also walk through a framework for how to think through your equity comp decisions and talk about how to use this wealth to support a life that you are excited about.

Our goal is that you can walk away from this webinar feeling confident about how to manage your equity comp and excited about the possibilities. Because that’s what’s most important. It’s not just about numbers in a bank account. It’s about how these numbers can enable something meaningful that you want in your life.

So, about us… I am Jenni Dazols. I am a former tech worker turned financial planner. My co-presenter today is Kiersten Pfenning, a CPA providing tech services to individuals and small businesses in the San Francisco Bay Area. I’ll have Kirsten introduce herself shortly, but let me start first with my own story.

So, I am a Fee-only Financial Planner. And I specialize in working with LGBTQ and Women in Tech who aspire to forge their own path in work and in life. So before this I spent 15 years in tech, most recently as a Director at a Fortune 500 big tech company. I’ve also had the opportunity to work on various passion projects for causes that I care about, which I’ll tell you more about in a second.

So, why did I leave a good tech career to become a financial planner. Because financial planning changed my own life. So, there was a lot that I liked about my own career, but the work came at a cost. I spent two to three hours commuting. I traveled nights away regularly, and I felt like I was always rushing from one meeting to another. I used to think that there was something wrong with me. I just wasn’t good at managing myself, obviously.

But then I read an article in the New York Times that was headlined,

“Stress, Tired and Rushed: A Portrait of the Modern Family.” And I thought, oh my God, that is us! And that’s when my spouse and I decided that we needed to make a change. We asked ourselves this question, “If we were financially secure, what would we change about our own lives?” And this led us to start defining an ideal vision for life and from there we developed a financial plan.

For us, it took seven years, but that plan got us to a place where we were both able to leave the security of salary jobs, take our kids around the world and have the free time to pursue dream ventures, including filmmaking and launching a charity bike ride. As for the equity compensation that I received in my own career, while I never won the lottery with it, it was meaningful.

By being proactive about managing our risk and being smart on taxes, we were able to make the most of it to help us on our journey. So, that is why the subject of this webinar is so important to me personally. Now, since taxes are a big reason why equity comp can feel so complicated, I want to introduce Kirsten to help us talk through the tax considerations around equity comp.

Kirsten: Hi, I’m Kirsten. As Jenni mentioned, I’m a CPA based in Oakland, California. I work with individuals and small business owners on tax preparation and planning. I grew up in the Bay Area and have lived here my whole life. So, while my background doesn’t include the tech industry many of the folks that I have the pleasure of working with have equity included in their compensation packages.

Like Jenni, I’ve been a follower of the financial independence movement ever since I stumbled across it while I was sitting in my cubicle working as an auditor for Alameda County about 10 years ago. I became hooked on reading about and implementing the principles of financial independence with the hopes of being able to buy myself a little bit more freedom down the road.

While I was never really interested in fully retiring in my thirties or forties, I knew that there were only so many years that I would be able to spend nine hours a day at my desk in the county admin building. I wanted the freedom to be able to chart my own path.

The term F*** You Money is thrown around a lot in the financial independence community, F*** You Money essentially means that while you may not be fully retired, you have enough of a financial cushion that you can pursue or walk away from opportunities because you want to, and not because you have to.

When the pandemic hit, I was incredibly grateful that I had the option to leave my job, which was no longer working for me and my family. My F*** You Money was what made it possible for me to step away from my cushy government job and take a chance on building my own tax practice.

While equity compensation was not a part of my personal journey towards financial independence, it’s a really powerful tool that many employees of tech companies have at their disposal. But I know that the tax implications can be daunting for folks who are new to that. So, one of the goals of this webinar is to kind of walk you through the different forms of equity compensation and give you a better sense of how it is that they operate.

Kirsten: To illustrate how different types of equity compensation work what I’m going to do is walk through a couple of simple examples using the same baseline scenario. For purposes of this example, we’re going to assume that an employee is single, takes a standard deduction, and receives a base salary of 200K per year.

This employee is eligible to receive 1000 shares of company stock with a fair market value of $100 a share. At the data sale, which we’re assuming is two years from the vest date to ensure that A) The long-term capital gains rate is applicable and B) that all holding periods have been satisfied. We’re also going to assume that this stock has appreciated to $150 a share at the date of sale.

Kirsten: Restricted stock units or RSUs are one of the most common and most simple forms of equity compensation. With RSUs, any shares that you vest in are valued at the fair market value on the date of vesting and included in your W2 as wages.

For tax purposes, there’s no difference between the salary that’s paid in cash and the value of the shares that you as an employee invest in. So, in this example, the employee will have an additional, a hundred thousand added to their taxable income for a total taxable income subject to ordinary income tax of just over 300,000. This pushes the employee into the 35% marginal tax bracket for a total tax due of just over 75K.

At the date of sale, the employee will have a realized to gain of $50,000, which is the difference between the value of the shares upon investing and the proceeds from the sale. At a 15% capital gains rate, this employee can expect to pay $7,500 in capital gains tax upon sale.

All right. And next up, we’re going to be talking about employee stock purchase plans or ESPPs. ESPPs give employee the opportunity to purchase company’s stock at a discount of up to 15%. There is no immediate tax implications of taking advantage of an ESPP program, however you do need typically to sacrifice cash in order to be able to make the purchase.

In this example, the employee would have $85K deducted from their take home pay in order to purchase $100,000 in company stock at a discount of $15,000. However, that does mean that the employee would only receive $115K in take home pay while being taxed on the full $200K in compensation. This results in a total tax of just under 41K in the year in which the ESPP is utilized. This is a great deal. 15% return off the bat is pretty solid but they do take a lot of cash out of your pocket.

Non-qualifying stock options or NSOs is a right to purchase company stock at a preset price. Similar to an ESPP, but without some of the favorable tax treatment. Unlike an ESPP the discount at exercise is included in taxable income.

In this example, with an exercise price of $85 a share the discount of $15K is included in taxable income in the year of exercise. The employee’s cost basis is the exercise price of $85 per share plus the $15 per share compensation element for a total basis of $100 per share. When the employee sells the shares, the total capital gain of 50K there will be a total capital gain of 50K for a total capital gains tax of $7,500.

Incentive stock options or ISOs are definitely one of the most complicated forms of equity compensation, but they can have a pretty spectacular upside. Incentive stock options are going to take us into the realm of alternative minimum tax or AMT.

Alternative minimum tax is this parallel tax system for certain forms of income that are normally tax free. You only owe AMT if your AMT exceeds your regular tax. And then the difference between your AMT and regular tax is added to your ordinary income. For most taxpayers, there’s a certain amount of ISOs that you can exercise annually, completely tax free as long as your AMT doesn’t creep above your regular.

If I kept all of the assumptions the same as in our prior example, with an exercise price of $85 a share, there would be no AMT implications because AMT would’ve been less than regular tax. So, in order to illustrate how AMT works, what we’re going to do is tweak the exercise price a bit down to $20 a share.

Like NSOs, ISOs give an employee a right to purchase company stock at a discounted price. With ISOs however, the discount or bargain element is used for calculating alternative minimum tax, which is added to ordinary income tax. Ordinary income tax is still based on the 200K base salary. However AMT, which has separate tax tables and exemptions is calculated based on a taxable income of $280,000, adding just under $13K to the employees total tax during the year of exercise. When the employee sells the shares, the cost basis of those shares is the exercise price of $20 a share for a total capital gain of $130K and capital gains tax due in the year of sale of $19,500.

Just a reminder that this example, as all examples that we’ve discussed today are assuming qualifying disposition. But one thing I wanted to mention with AMT is that when you pay it, you are automatically also triggering a credit that you can carry forward and use to offset tax due in years in which your AMT is lower than your ordinary income tax. It’s not reflected here in this example, but I just wanted to mention that it is possible to use the AMT credit to offset tax owed in future years as your tax situation changes.

So, that wraps up the four basic types of equity compensation that we’re going to be going over today. So, just to kind of wrap things up, I wanted to go over a couple of common mistakes that I see folks make, so that hopefully you can avoid them.

I know that that’s a lot of information to process. I hope that these examples shed at least a little bit of light on the tax implications of equity comp. If you’re still confused, just know that you aren’t alone in this. Partnering with a good tax professional can give you the confidence and to leverage this incredible tool that you have to be able to achieve your financial goals. Honestly, probably a lot quicker than you even may think. So, with that, thank you for your time. I’m just going to pass things off to Jenni.

Jenni: Okay. So now, you know how these different types of equity comp work. What should you do? Should you hold or sell? Should you exercise and how much and when?

The best answer for you is dependent on a lot of different considerations. Some of these are easy to answer, some will take deeper thinking and some might just be your best darn guess. But, there’s one question that I think is most important to ask yourself and that is this, “What do you want this money to do for you? What are you hoping that this money will fund? Is this money that you hope to use for goals that are really important? Like buying a house or paying for your kids’ education, where you’d have real regret if things didn’t work out? Or is it for aspirational goals, like retiring early, where you can take on more risk?

If you think about your equity in terms of what you wanted to fund for your life, you have something to anchor yourself to when it comes time to make decisions. So, let’s talk about how to think through what to do.

Now, for those of you who have stock options, you have more decisions to make, and some of these have real deadlines. So, here’s a framework that I found useful when working with clients:

Now, if we assume that you have ISOs and you are expecting that the shares will continue to go up in value, then the sooner that you exercise, the more that you’d be able to minimize AMT. You may have the option to early exercise before those options are even invested.

That’s called an 83B election, and that can help even more. With that said there is an opportunity cost to exercising. There is real cost to exercise, right? You’ve got to pay tens or maybe even hundreds of thousand dollars to exercise plus the associated tax bill. And that means that you’re tying up your money from being able to do other things. So, that could be a reason to delay.

That said the whole beauty of ISOs is the potential of getting long term capital gains on all the appreciation between what you paid at exercise and what you sell it at. But to do that, you’ve got to wait to sell for at least until two years after grant or one year after exercise. So, the sooner you exercise, the sooner that you start the clock.

As a last note, it’s important to remember that if you end up leaving your company, you generally only have 90 days to exercise after you leave. So, you want to make sure that you don’t accidentally lose these options by not taking any actions.

All right, how much to exercise? It doesn’t have to be an all or nothing strategy. One common strategy is to exercise just enough to stay under AMT. Now, remember that AMT does not get triggered until your AMT bill is greater than your regular tax bill. So, you can exercise just enough to stay on under AMT. The more you sell the greater risk you have of owing AMT.

But it’s also important to remember that with AMT and ISOs, the taxes is really just a timing thing to ensure that the IRS is taxing you advance of selling those shares. So, those taxes you paid are not lost forever. You should be able to get it back in the form of AMT credit when you ultimately go and sell those.

Another important point to consider is the practical matter of how much cash you have available to pay for exercising. Because the more you exercise, the more it costs. If you don’t have the cash, there are companies like Sec Fi or Equity B that can help you finance that. But of course, they are going to take their share as well. So there’s a lot to think about with ISOs and that’s really because of their special tax treatment.

With NSOs, it’s quite a bit simpler. So remember that with NSOs, you are taxed as exercise as W2 income. So, there’s no real tax advantage to exercising earlier. Now, you might think, well, if I exercise at whole for one year, then it becomes long-term capital gains and then I get to pay a lower tax rate. That’s true, but there is opportunity costs of tying up the money that you pay to exercise in tax. Plus there’s the risk that the shares could drop while you’re waiting for that one year to pass. So, the general rule of thumb is if you’re bullish, just wait and hold the options. Take advantage of the fact that you are able to participate in the upside of your company without having to tie up your money. And that’s the beauty of leverage that’s inherent in NSOs.

Now, if those options represent a big chunk of your net worth, it could be worthwhile to diversify in which case come up with a systematic plan to do so. Because you have to pay ordinary income tax at exercise for NSOs, you’ve got to think carefully about how exercising will impact your overall taxes. Ideally, you can choose to exercise when your tax bracket is lower. Perhaps in a year where you or your spouse is changing jobs or in a year where you expect your other compensation, like bonus or other equity comp to be lower.

Okay. So, now let’s talk about what to do when you’re holding the share. Either from those options you’ve just exercised or through RSU or ESPPs. So, you are bullish about the company…should you hold onto them? Now, this is when it’s really important to have an objective view. Think back to the goals that you want this money to fund. Because here’s the thing: as much as you may believe in the company, the reality is that most stocks fail over the long term. And the long term is what you need if you want this money to fuel your financial independence.

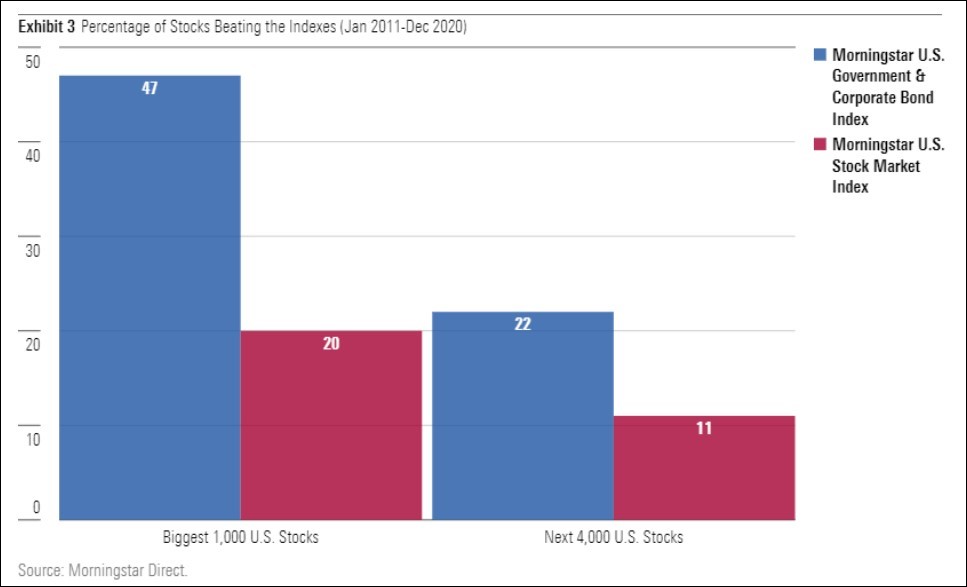

So, let me just share some sobering statistics. Morningstar did a study of the top 5,000 stocks from 2011 to 2020, which is a decade that enjoyed an amazing bull market. What this chart is showing is the percentage of stocks beating the index. Red is the percentage of stocks that beat the stock market index. Blue is the percentage of stocks beating the bond market index. And what it’s saying is that if you look at the top 1000 companies, only 20% beat the stock index.

Most of them couldn’t even beat the bond index. And if your employer isn’t one of the top 1000 largest, it’s a smaller company, then your chances are even worse. So, this is why, if you want this money to fund something that is really important to you, then seriously consider selling and diversifying at least a portion of your shares.

Now, when should you sell? With RSU and NSOs, there’s no avoiding paying ordinary income tax upon vest or exercise. So, if you sell immediately after vest or exercise, there’s no gain or loss. There’s no tax implications. With ESPPs, you’re pretty much guaranteed some gain since you’re buying in a discount, usually 15%.

So, if you sell right away, you’ve at least captured that discount. Now there is some benefit to holding and making it a qualified sale, but one could argue that for the sake of locking in the gains and diversifying, selling immediately with ESPPs is also a good strategy. Now with ISOs, there generally is a significant tax benefit to waiting through the holding period to make it a qualified sale. But again, taxes should not be the exclusive driver of your strategy. Because here’s the thing, it’d be all for nothing if the share value tanks while you’re holding it.

Jenni: Okay, so here is the fun part. You’ve got your shares and it’s worth quite a chunk of change. Maybe it’s worth more than you’ve ever imagined having at this stage. What can you do now? Maybe you’re dreaming about a break, a dream adventure, a career change, starting a business, or early retirement. A lot of people ask, well, how do I know when I have enough to do any of these things?

So, it’s actually a simple math problem. It kind of blew my mind when I first learned about it. So, I love this framework and it comes from a book that I highly recommend. It’s by Vicki Robin, it’s called Your Money or Your Life.

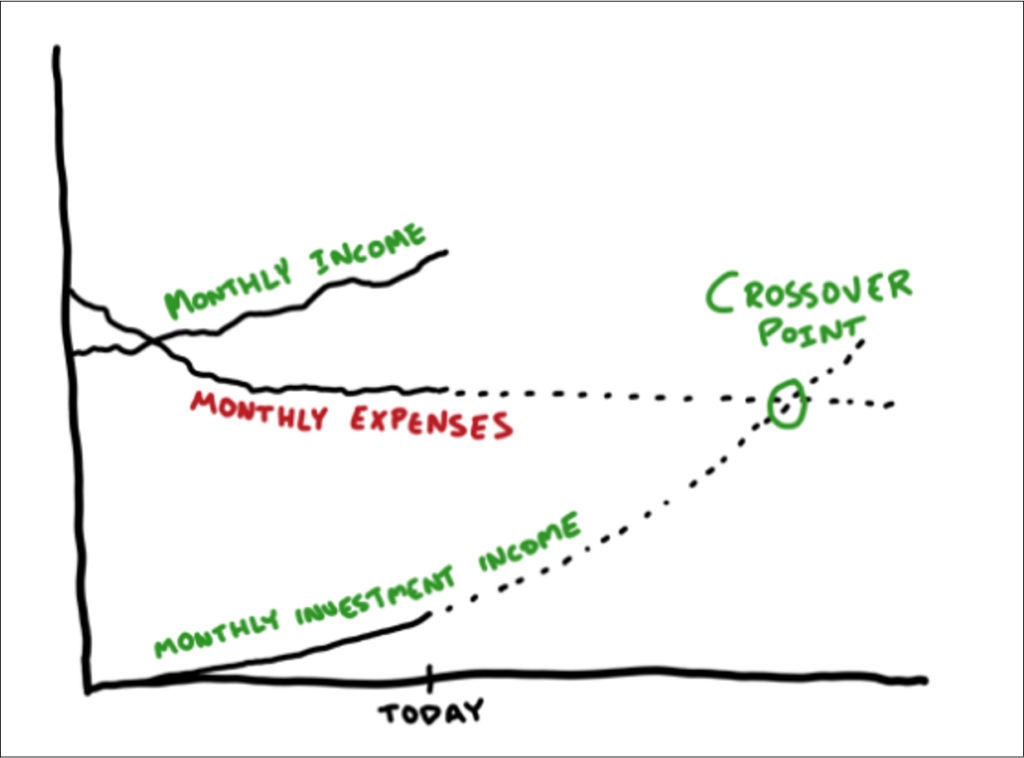

So, first line you see on the top is your income right? Hopefully your earning income is growing over time and you’re saving a portion of this income and you’re investing that. And those investments produce income as well. Right? At the same time you have your living expenses and the crossover point is when your investment income is equal to your living expenses. That is what most people define as financial independence, because that is when you can stop working for money and let your money work for you.

Now, the question is how much income can your investment provide. And I recommend just using the 4% rule as a rule of thumb. So, the 4% rule it’s based on analysis of historical market performance. And it says that you should be able to withdraw 4% of your savings without running out of money. Assuming that that money is invested in a diversified portfolio. So, let me give you an example. Let’s assume you need a hundred thousand dollars to live. Well at using the 4% rule, you would need a nest egg worth two and a half million dollars to support annual living expenses of a hundred thousand dollars because 4% of two and a half million is a hundred thousand.

You might be thinking right now, two and a half million dollars is a lot of money. That feels very, very, very far away from my reality. And indeed it’s a lot of money. But here’s the thing…. It does not have to be all or nothing. So, let’s say that you have some dream work that you really want to go into, but it pays terrible compared to what you’re making.

It does pay something though. If we assume that your passion business can make at least $70,000 a year, right? Maybe not the multiple hundreds of thousand dollars that you’re currently earning in your job, but it can pay something. If it can make $70,000 a year and you need a hundred thousand to live, then you only need to come up with $30,000.

Right? So, if we apply the 4% rule, then you only need a nest egg of $750,000 to support this life. And if you think about it this way, that’s much more reasonable. What possibilities could that open up for you? After all, if the main value of having money is to provide you the freedom to work on the things you love and to live in the way that you want to live, it is possible that you might already have that freedom. From a very personal standpoint, that’s the kind of math that gave me the confidence to leave a secure job. And that’s what I love most about the work I do. Helping people think through new possibilities with their money.

All right, The final subject that I want to discuss is how to keep that wealth that you’ve earned. So, I love these two quotes from Morgan Housel:

“There are many ways to get rich, but only two ways to stay rich: be paranoid enough to plan for the worst, but optimistic enough to stay the course.”

“Compounding doesn’t rely on earning big returns. Merely good returns sustained uninterrupted for the longest period of time-especially in times of chaos and havoc- will always win”

Because you’ve got some wealth now. And with your equity comp, you may have been blessed by a home run or at least a single or double. But if you want your wealth to last for the next 30, 40, 50 years or beyond, then you need to protect yourself from an unexpected disaster that can wipe you out no matter how much you’ve saved. And you need your money to keep growing through all of these decades.

Because you’ve got some wealth now. And with your equity comp, you may have been blessed by a home run or at least a single or double. But if you want your wealth to last for the next 30, 40, 50 years or beyond, then you need to protect yourself from an unexpected disaster that can wipe you out no matter how much you’ve saved. And you need your money to keep growing through all of these decades.

If you can do that, then even a modest windfall say a hundred thousand dollars in RSUs in your thirties could be worth $2 million in your lifetime and that’s the power of compounding. And compounding can only go on uninterrupted. If you have a financial plan that takes into account all facets of your financial life.

And this is the way that I think about financial planning, both for myself and for my clients. It actually starts with imagining your ideal vision for your work and your life, and then working backwards to figure out how to set up your finances to support that vision.

So, we’re at the end of our presentation and we hope that you’re walking away excited about what’s possible with the wealth from your equity compensation, and more confident about how to make it happen. If you need some more help, please reach out. Here’s our websites and our emails. We both love doing this work and we’d be happy to talk to you about your financial planning or tax needs. Thank you.

Location

For our clients’ convenience, we conduct meetings virtually. While our home base is in San Francisco and the Bay Area, we proudly serve households across the U.S. and internationally.

1999 Harrison St

Suite 1800

Oakland, CA 94612

415-295-6206

Investment advisory services offered through Equita Financial Network, Inc. an Investment Adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Equita Financial Network also markets investment advisory services under the name, Modern Family Finance, LLC. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

Securities investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Copyright © Modern Family Finance 2023. All Rights Reserved.