How to Buy Your Own Health Insurance in California for 2024.

When I left my Silicon Valley tech job after 15 years to start my own business, one of my main concerns was how to buy health care coverage for my family. Access to health care coverage simply isn’t a concern when you work for a Fortune 500 company competing to offer the best benefits packages to attract top talent.

As a financial planner who specializes in working with self-employed individuals, I see how health care can be a roadblock if you’re considering launching from salaried security. Freelancers, contractors, job seekers, and those wanting to take a break from conventional work life or retire early worry about how to access comprehensive and affordable coverage.

This month during open enrollment, I interview Ariana Brill, a healthcare advocate who also has a law degree and MBA. After her own frustrations witnessing her partner struggle to get health insurance, she opened her own business helping individuals in California navigate their options and enroll in coverage. She shares with us the latest on accessing healthcare through Covered California for coverage in 2024.

In this 25-minute video webinar, Ariana answers the following questions and more. If you’re short on time, these key points in Q&A below are broken out from content of the video.

Key Points

- How comprehensive are Covered California plans compared to employer plans?

- The two areas where people struggle

- How to know if your doctor accepts Covered California

- Gold, silver platinum…how do I know which plan to choose?

- What about high deductible plans?

- What if I am laid off during the year?

- Should I sign up for COBRA or Covered California?

- What about other private options outside of Covered California?

- How do I actually enroll?

- How is my income calculated?

- What is the cost for a single woman in Oakland starting a new business and expecting to earn $25k?

- What is the cost for a family of four living in San Francisco earning $200k?

- What about dental insurance and vision insurance?

- What kind of coverage should I get if I’m planning on spending a lot of time abroad?

- What is the process for working with Ariana? (good news: it’s free!)

Jenni: Hey everyone, so if you’re a freelancer or contractor or you’re in between jobs or you’re thinking about taking time off to do your own thing or go on a sabbatical, you’ve probably grappled with the problem of “What do I do about healthcare insurance?”

So as a financial planner specializing in working with women and LGBTQ professionals in the California Bay Area, I get this question often. So I wanted to invite Ariana Brill, who has helped guide thousands of Californias through the labyrinth of health insurance to talk to us about the ins and outs of accessing healthcare.

So I reached out to Ariana because I don’t think she’s your typical health care insurance agent. She has spent many years living in co-ops along the range of California. And she really sees healthcare access as a social justice issue, which I love. She’s also a hardcore Californian. She grew up in Santa Barbara, got a law degree and MBA at UC Davis. But she really got into this personally and now she has a business called, “Ask Ariana” that helps individuals, families, and small businesses in California find the right healthcare coverage for them.

I kind of I really love your personal story of how you got interested in this space.

Ariana: Well, thanks. You know, I was working for an affordable housing nonprofit when the Affordable Care Act first passed. And at that time, you know, I was just trying to learn how to work the system because I had a partner who had a chronic illness and it really mattered.

And I got licensed thinking that I would just figure things out for myself and my loved ones, and maybe some of the people who lived in the affordable housing units that were part of my nonprofit. And my name got loose in the Berkeley student co-ops and my phone started ringing off the hook. So had originally envisioned this as just something to do on the side for people I cared about, but over the years, it’s grown into a really large operation.

Nowadays I have four ladies working with me and, we have helped thousands of people all over the state.

Jenni: Awesome. Okay. That’s really great. I love the personal story too. I think that’s like the best kind of job when you’re doing it because you see a need yourself. Cool.

How Comprehensive are Covered California Plans to Employer Plans? (02:18)

Jenni: Imagine you’re talking to somebody who is going to leave their employer….maybe it’s to take some time off or maybe it’s because they want to become self-employed and they are worried about what to do about their health insurance. What would you tell them?

Ariana: Covered California is available for everybody and you can absolutely can health insurance outside of a job.

People often worry about pre-existing conditions. Fortunately, that’s no longer a thing post-Obamacare, so you will be taking care of. The system works on a sliding scale, so it’s really meant to be affordable wherever you’re at. So, you know, lower-income people get really affordable options. And, if you’re a higher earner, there are options available for you too. It’s just that the government’s not going to help you pay for your premium.

Jenni: Oh, that makes sense. Thank goodness for that.

The second question that I get a lot too, is like, well, I have a really good health plan with my employer. How comprehensive are these covered California plans? And how do I even know whether I’m going to be able to get the same access or be able to see the same doctors as I used to?

Ariana: Yeah, that’s a great question. So there’s a widespread of comprehensiveness available through California. Obviously, more comprehensive plans are more expensive.

The areas where I see people struggle… the plans available through Covered California but don’t have a lot of out-of-network coverage available in the way that your employer plan might. There are PPO options available, but they have high out-of-network deductibles. So, if you’re used to being able to just go wherever you like without worrying about a network, that’s not going to be as true in options available through the exchange, or really anything that you can purchase on your own outside of a job.

The other area where I see people struggle is when they want to work with Stanford. Stanford is not in-network for anything available through the exchange for primary care. Most people are able to find something that works with their provider. They’re able to keep their doctors, they are able to purchase coverage that’s as comprehensive as they need it to be with the caveat of those two areas where I do see challenges access to Stanford and out-of-network coverage.

Jenni: That’s really helpful. If I wanted to check whether my doctor would be covered, how would I know?

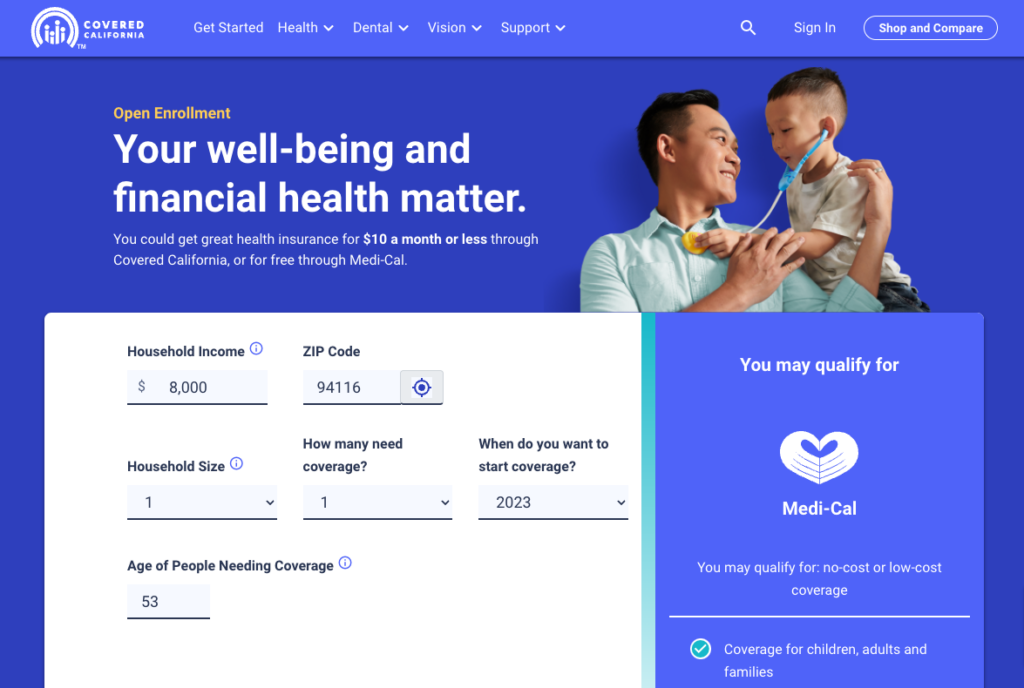

Ariana: So Covered California has a really great tool called “Shop and Compare” where you can put in your age and your zip code and your income, and it’ll show you your options and you can put your doctor’s name in there too. It’ll show you which plans are in the network for that doctor.

Gold, Silver, Platinum…How do I know which plan to choose? (04:24)

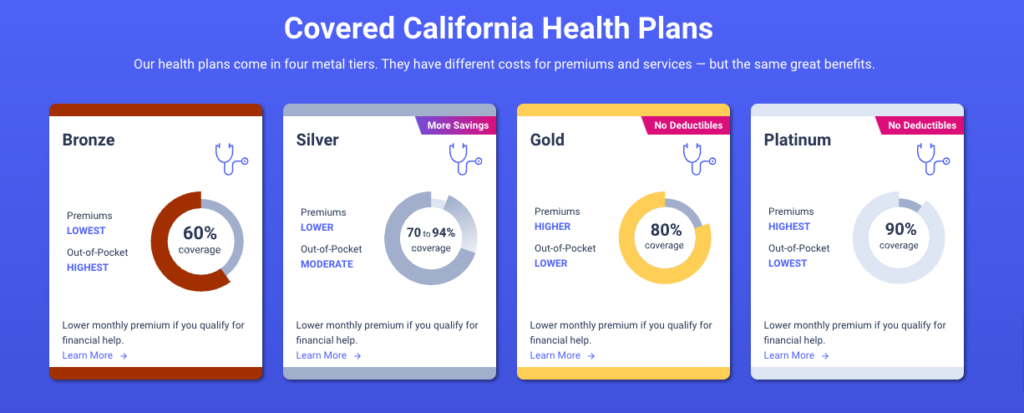

Jenni: Then there’s all these like colors, right? Silver, Gold, whatever. And then how should I think about it? Should I just try to look for the plan that’s most similar to my employer one? Should I do a little bit more thought about it? What should I do?

Ariana: Yeah. I mean, you want to try to get away with as little coverage as you need, because that’s how you save money. So your employer plan may be way more robust than you actually need that would actually be cost-effective for you once you’re paying the premium yourself.

Bronze, silver, gold, and platinum are the medal tiers available. I like to think of it as small, medium, large, and extra large. For somebody who really doesn’t anticipate using the care at all and just wants a safety net in case something major happens, bronze is the appropriate place to be for most people.

Most of the time, silver is the right medal tier. If you are anticipating pregnancy or surgery, or if you have a lot of needs, gold might be appropriate. It’s very rare that platinum is the right choice unless somebody is dealing with something very major. Like an ongoing cancer treatment or something like that.

Jenni: How should I think about high deductible plans? I read actually there was a Wall Street Journal article that came out and said “Most people should get a high deductible plan”. How do you feel about that?

Ariana: I read that article too, and I really disagree with it.

So there’s HSA compatible high-deductible health plans. So in order to be able to have a health savings account, which is a vehicle where you can put money in pre-tax dollars and then pay for your health care out of that account in pre-tax dollars, in order to take advantage of those tax benefits, you must be enrolled in an HSA compatible high deductible health plan.

So the way those plans work, the plan will cover preventative care for free checkups, immunizations, cancer screenings, and birth control, but for anything else, you pay the full cost of the care as if you didn’t have insurance until you hit the deductible, which is typically around $7,000, then the plan pays for everything above that.

So, for somebody who really isn’t anticipating needing anything, it can be a good way to stockpile money in pre-tax dollars, but if you are doing anything regularly such as you’re visiting specialists or taking medication or really using the care at all, it can turn out to not really be that cost-effective. What really scares me about it is that I watch people on these plans hesitate to get care when they need it because they know they’re going to pay the full price and it’s going to hurt.

For me as somebody who is passionate about getting people access to health care, I just really hesitate to put somebody in a position where they’re going to think twice before going to the doctor.

Jenni: Yeah, that’s a good point. I will ask a follow-up question though, because as a financial planner, I’m trying to figure out the most cost-effective way to get coverage.

If somebody is paying, let’s just say it’s $7,000 for a high-deductible plan. If someone thinks like, oh, if I buy a silver plan, plus out of pocket, it’s going to be over $7,000 or whatever, right? Like cost-effectively, Like, I can pay up to $7,000 I would still be winning. Would it then be worth it or are there other catches in terms of like the access or the type of care you would have under a high deductible?

Ariana: Well, it’s mostly just about what’s unanticipated. So you may think I’m not using a whole lot of care right now. When I do the numbers, it comes out to be more cost-effective to have the high deductible health plan. But then, something happens, you get appendicitis or whatever, and, all of a sudden you get a really big medical bill, which can upset the balance of what turns out to be cost-effective.

Ultimately, insurance is always a very literal gamble. You just have to make a guess about what’s going to happen in the coming year, and because we can’t predict the future, we can never know for sure which plan is going to be most cost-effective. Just have to make a guess and hope for the best.

Jenni: It’s a little bit like financial planning, make some educated guesses

What if I am laid off during the year? (08:08)

Jenni: Okay, So is outside of Covered California, should somebody be considering COBRA or considering other private plans, other, I’ve heard of these other shared plans outside of Covered California. What do you think about?

Ariana: First of all, I really, would caution people against they aren’t regulated in the same way that health plans are.

They are not legally required to pay your bills. It’s something you want to think very carefully about, and I personally do not work with that just as a moral issue. Some insurance companies do have a couple of options available if you enroll with them directly that aren’t available through Covered California.

But by and large, the options and the rates are very similar. I don’t really see a need for people to go directly to an insurance company. I think the exchange does a good job of curating plans, and, they standardize them in a way that really lets you compare apples to apples. And also, if you have a shift in events partway through the year like if your income drops beyond where you thought it was going to be…. if you’re enrolled directly through an insurance company, you can’t get access to financial assistance mid year. You have to wait until open enrollment. Whereas if you’re enrolled through Covered California, you can report that change mid year and start receiving financial assistance in May.

So I always encourage people to go through the exchange rather than directly with the insurance company, just so that they have that option available to them if they need it. Now, COBRA is another story that can often make sense for folks. It really just depends on where your income is. So if you are making enough money that you are not eligible for financial assistance, then COBRA starts to make more sense.

If you’re eligible for financial assistance, COBRA is always going to be more expensive. The way that COBRA works, you are just staying on the same health plan that you were on while you were at your job, but you are now paying both your portion of the premium and the employer’s portion. So, if your COBRA plan is more robust than you need for your health care needs, then COBRA is going to be more expensive than Covered California because you could choose a less robust plan through Covered California that’s more suited to your needs.

If you are in a position where you have already met the out-of-pocket maximum or deductible for your COBRA plan, that’s a great reason to keep COBRA at least through the end of the year or the end of the deductible cycle.

Or if you have providers like I alluded to, Stanford can be a difficult thing to access through the exchange. If you have a Stanford doctor that you really want to keep their network for your COBRA plan, sticking with COBRA may be your best option.

Jenni: Got it. Okay, that’s helpful. Alright.

How do I actually enroll? (10:37)

Jenni: So if I want to enroll. What do I do? And then also what happens if it’s like happening mid-year, like I’m leaving my job, not around this time.

Ariana: So anyone can enroll for any reason during open enrollment, which is November 1st through January 31st each year. Outside of that time frame, you need what’s called a qualifying event to enroll. It’s basically a good excuse, like moving, losing coverage through your job, even if you’re being offered COBRA, getting married, having a baby, you know, big life events will allow you to enroll mid-year. Either way, you need to enroll by the end of the month for the following month. So you have until the end of October to apply for, November.

And, the enrollment process is pretty straightforward. The Covered California application can be a little tricky and the website can be buggy and I always recommend that folks partner with an agent just so that you can get some expert advice on that. But it’s, you know, it’s something that if you know what you’re doing should only take about 15 minutes.

Jenni: Got it. Okay. Very helpful. And if they needed help, they can call somebody like you, right? Perfect. Okay. Now help me understand costs. So, you know, if I’m somebody who is leaving my job because I’m taking time off or being self-employed, my income is going to dramatically go down.

So let’s pretend I’m a single woman living in Oakland and I’m going to start my own business. So I think I’m going to make almost nothing. I’m going to make like maybe $25,000. Right. So what would it cost for me to get, like, let’s say a silver plan, which you say most people it’s relevant? Versus I’m a single woman living in Oakland, but I’m earning a full salary of like, say $200,000 plus.

Ariana: So if you are only earning $25,000 as a single woman in Oakland, you have a number of silver options available that are really quite affordable. Kaiser would actually be $0. There are plans through Aetna and Anthem that would be around $20 bucks a month. And if you really need a PPO, you could do that for more like $160.

Now if you’re not eligible for financial assistance, the rates on those plans are going to be significantly higher because the government won’t be helping you foot the bill. And at that point, a silver plan is more like $555 a month for the cheapest silver plan if without assistance.

Jenni: Gotcha. And what if you were a family of four?

Ariana: Family of four is actually going to be pretty similar. So you asked about a statistic where a situation where we have a family of four earning around $50,000 in San Francisco. So for that family, any children 18 or under would go on to Medi-Cal, which is a free public health program for people who are very low income.

The adults in the family would be eligible for coverage through the exchange and rates would be very similar to the example we just discussed. So there would be a Kaiser plan available for $0. Something through an HMO through Blue Shield or Chinese community would be more like $30 a month. And then there are PPO options that are considerably more expensive. Now we’re looking at more like $400.

Jenni: Gotcha. And if they were not getting subsidized because they were making enough money?

Ariana: At that point, the Children would be on Covered California along with the parents. You had asked about an example of a family of four in San Francisco earning $200, 000. And I think it would surprise most folks to learn that even at that high of an income level, you would still be eligible for financial assistance to the tune of like $800 a month. So for that family, you could have the whole family on a Kaiser silver plan for around $1,200. Blue Shield HMO or Chinese community would just be a little bit more expensive. And a blue shield PPO would be around $2,000 a month.

Jenni: Okay. All right. So it’s not cr*zy. Like $1,200 bucks a month for a family of four. It’s a lot, but it’s not cr*zy.

Ariana: But for a family making a couple hundred thousand dollars, the hope is that that would be affordable.

Jenni: Gotcha. And what income are they actually looking at? Like, are they looking at my last year’s income, next year’s income? Are they looking at AGI investment? Like what is income for these calculations?

Ariana: That’s a great question. It’s AGI, essentially it’s technically something called modified adjusted gross income. There’s some really rare circumstances in which that number comes out to be a little different than AGI, but for 99 percent of people, it’s just your AGI.

And weirdly we’re reporting how much we think you will earn in the current tax year. So if I were applying right now in October of 2023, I would be reporting how much I expect to earn in total for the 2023 tax year. Now, especially early in the year, that could be challenging because you’re trying to predict how much think you will earn in the future, which there’s no way to do perfectly. But you just have to take your best guess and then you can always go in and change it later if your guest starts to feel inappropriate.

Jenni: Do you have to provide any proof or anything? Like, how do they know what you’re doing? I guess you have to file tax returns at some point, right? So they’ll know.

Ariana: Yeah, that’s exactly right. So when you apply the system, we’ll compare the number you provide against your most recent tax return. And if the number you offer is significantly different than what was last on record for you, the system will typically ask for proof of income. That scares a lot of folks because they’re like, “I’m starting a business. How do I prove anything?” But it’s really simple. It’s a form that you fill out where you write down your income figure and you sign your name. It’s an affidavit where you just attest to your guess. It’s really straightforward. Now, at the end of the year, when you file your income tax return, they’ll look at how much you actually earned for that year and they’ll compare that to what you reported on your application.

And, if you earned more than you thought you were going to earn, they’ll have you repay some of the assistance you received. And likewise, if you earn less than you anticipated, you’ll get some money back on your tax return. So the system’s designed for it to always come out in the wash. There’s no penalty for underestimating. You will end up paying what you would have paid if you had magically guessed your income correctly to begin with.

Jenni: Okay, gotcha. So the squared all the way out when it comes to tax time,

Ariana: Yeah, you can’t avoid paying the piper.

Jenni: Yes. Yeah, that’s fine. Right. I think it’s just the fear is that you estimate wrong because if you are, like you said, starting your business or taking time off and thinking, I don’t know how long it’s going to take me to get a new job. It’s hard to estimate what your it is.

Ariana: I’ll say that. Almost literally no one guesses correctly just cause it’s hard to predict the future. So almost everyone ends up either getting a little bit back or repaying a little bit, just because you’re going to earn a couple thousand dollars more or less than you thought you would, no matter what.

Jenni: Yeah, that makes sense. Okay. If you’re thinking, look, I’m planning to take some time off, I’m going to go on to Covered California. Is there some financial planning things that they should be thinking about just as they approach the cost of healthcare? Tell me about that.

Ariana: Yes, absolutely. I mean, first of all, I would say milk your employer coverage for anything you might need. That you can get out of the way ahead of time. So go get that new pair of glasses or those orthotic fittings or whatever it is. There’s also some games to be played around the time of the year.

So if you’ve been at a very high paying job and you quit in October, when you apply through the exchange, you’re going to have a high income for the last few months of the year. So the rate’s going to be expensive. Whereas if you wait until January to quit, now all of a sudden your current tax year income will be significantly lower and you’ll be eligible for financial assistance. I know it’s not always realistic for everyone to time their departure in that way, but to the extent that you can quit early in the year, you’ll make yourself better off.

Jenni: That makes sense. Yeah, well, I mean, health care is a really huge concern for people when they think about, hey, I want to take some time off to take care of my family or something. It’s like, what do I do if they don’t have a spouse or a partner that they can tack on? Right? So, okay, so those are, those are some great tips.

What About Dental and Vision Insurance? (18:02)

Ariana: Well, Cover California does have dental plans available.

I guess the first thing I’ll say about this is that if you have COBRA offering dental and vision, that’s often a good move, and typically you can elect the dental and vision and decline the health. The types of dental and vision plans that you can get access to through an employer group are typically more cost-effective and more robust than what you can get when you apply on your own, just because of the risk pool.

Is so different when you’re an employee group versus somebody who’s electing to purchase dental insurance. If corporate dental vision is not a good fit for you, you can absolutely purchase those things on your own. Honestly, I’m not a huge fan of dental insurance. I find that it often doesn’t help people in the way that they would imagine.

There are maximum payouts and limitations and for most folks who are able, it’s usually more straightforward to just pay out of pocket for your dental care. Vision insurance is essentially a payment plan. So it’ll run you around 14 a month and then it’ll pay that out when you go get your eye exam.

So if you’re somebody who has some income and or some savings stocked away, you might not need a vision plan. And that’s another thing that you can do before quitting your job, right? Go to the eye doctor and get your contacts. And then sometimes you can just skate by until your next job.

Jenni: That makes sense. Okay.

What kind of coverage should I get if I’m planning to spend a lot of time abroad? (19:26)

Jenni: Switching gears a little bit. Let’s talk about travel and just people who are living in two places, multiple places, right? So if you were, let’s say, planning to take a sabbatical and you are going to spend several months abroad or part, whatever, part of your year abroad, and you’re not employed, right? What kind of insurance should you be getting? Both to cover your health in the U. S. and health abroad.

Ariana: So, even if you leave the country for a few months out of the year, you are still required by the state of California, if you file California taxes, (California) will want to see that you had health insurance the whole time.

Otherwise, you’re subject to the income tax penalty for not having health insurance. There’s a little bit of a grace period, but I always recommend that folks just keep something in place because if you cancel the insurance, then you come back you may not have a qualifying event to enroll.

So, if you’re really going to be gone for most of the year you could maybe get away with a more basic health plan, you could do a bronze plan, intending not to use it but then you have an emergency coverage in place if something happens when you’re back in the US.

Then I recommend that folks pair stuff like that with a travel health insurance plan. Travel plans are really inexpensive because they are not major medical coverage. They won’t cover your birth control. They won’t cover your maternity. They’re meant to cover things that happen while you’re traveling. A broken leg, an infection, a dental emergency. Those types of plans are really affordable and you can purchase it for whatever period of time you will actually be abroad.

So I would combo those two things.

Jenni: Gotcha. So even if somebody is saying, look, I only spent two months of the year in California and I’m going to spend most of it abroad, you would still say, look, you should still have some kind of plan in California to get the most basic one and then buy travel insurance. Is that what you’re saying?

Ariana: Well, I mean, in that scenario where you’re really only in the U. S. for a couple of months out of the year, I would speak with your accountant about whether you would be subject to the income tax penalty in that situation. That’s something to consider.

Because of the ins*ne cost of health insurance in this country. I always worry about people exposing themselves to financial liability when they go without coverage. It seems like you could just skate by for a couple of months and probably you can, but what happens if something happens? For someone who’s living abroad long term and they’re really living in a different country, there are expatriate health insurance plans available that are major medical coverage that will cover pre-existing conditions and maternity and ongoing care. Plans like that are more way more expensive than travel coverage because they’re more robust and they often will cover returns to the U.S. So that’s a good way to go if you really are, centered abroad.

Jenni: Yeah. I can say from personal experience of having been centered abroad that, if you look for travel insurance that will cover you to visit the U.S. most of them won’t because travel insurance will not. Yeah. Yeah.

Ariana: But expatriate insurance will. That’s not designed for a trip. It’s designed for someone who’s really living abroad long term. But it’s more expense.

Jenni: Makes sense.Yeah. Okay. Well, tell us a little about like,

Let’s say I want your help to sort through all this stuff, right? Actually, I do. I need your help. So I’m going to be calling you shortly because I need to figure this out! What is the process to work with you? how do you get paid? Can you tell us about your process of Ask Ariana?

What is the process for working with Ariana? (Good news: it’s free!) (22:32)

Ariana: Yeah, so the first thing I would want you to know is that we don’t charge for our services. So it’s free to you to work with me. And if I’m able to place you on a plan that works for you, I get a commission from your insurance company. You pay the same rate that you would pay whether or not I help, but I get to take a piece of what you are paying to your insurance company.

In terms of how the process works….

The easiest thing to do is just book an appointment on my website. It’s askariana.com. Pick a time slot that works for you fill out the intake form and we’ll call you at the appointment time and talk with you about you and your family and your needs and what you’re anticipating will help you figure out which plan is most sensible. And then we’ll do the application for you. So you just hang on the phone and chat with me, and I’ll take care of all the paperwork. It would be an honor to help any of your clients.

Jenni: Thank you.